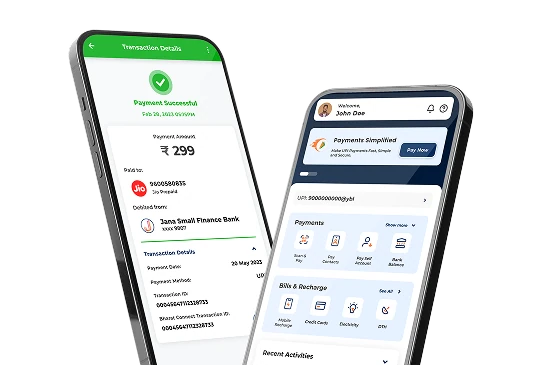

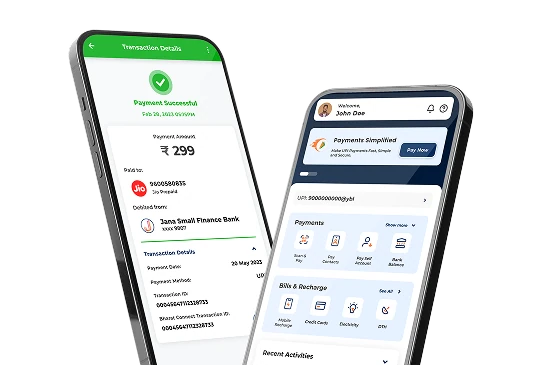

UPI That Pays Everything

Pay, collect, scan, and clear multiple utility bills in one go.

Instant confirmation for payments.

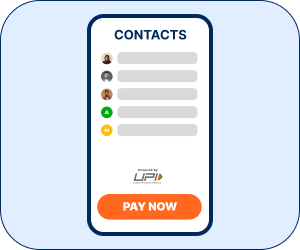

Saved payees — one-tap re-pay.

Bill scanner — scan paper bills, pre-fill amounts.

Split payments — divide bills across contacts.

Bulk pay — one checkout for many bills.

Collection links — share payable links for customers.

Recurring payments — schedule monthly/weekly payments.

Exportable receipts — CSV / PDF ledger for records.

UPI-authorised authentication at every payment. Transaction limits follow RBI/UPI rules.

End-to-end payment flow with settlement transparency and timely confirmations for

instant money transfer.

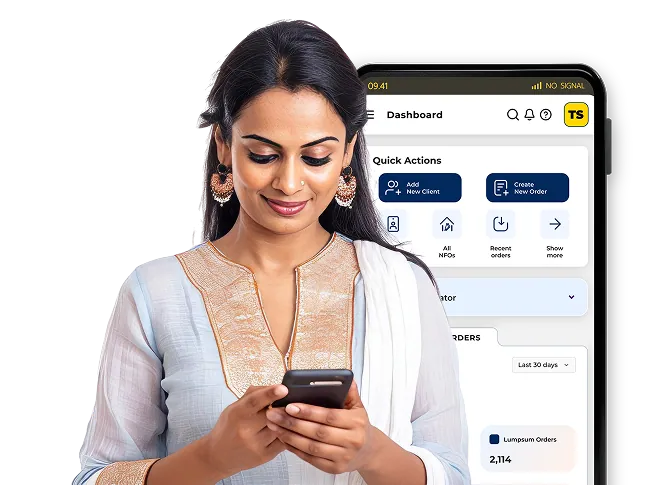

TPAP (Third Party Application Provider) is the technical partner that routes UPI payments and connects billers. Indipe integrates with TPAPs to aggregate bills, route UPI payments securely and settle amounts with utility providers. Indipe UPI also works as a secure payment gateway, giving startups and merchants the flexibility to accept payments online just like they do through other UPI payment apps.

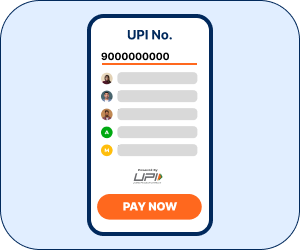

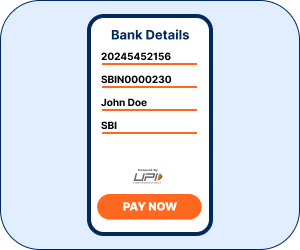

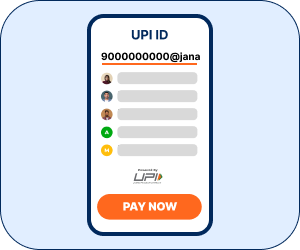

Use Scan and Pay for QR-based payments, Pay to Bank to transfer to account numbers, or Pay to mobile number / Pay to Contact for quick transfers. You can also Collect Money from UPI ID via collection links or QR. Whether you want to pay to bank account directly or figure out how to pay on mobile number, Indipe makes both flows simple.

Yes — you can accept payments online, generate collection links, share merchant QR codes, and export receipts. Use bulk-pay or collection features to manage vendor payouts and customer collections reliably. Merchants can even use the built-in QR scanner to accept in-store transactions, making Indipe the best UPI payment app choice for retailers.

All major services across 31 categories are supported (electricity, water, mobile, gas, DTH, education fees, municipal services, and more). Save billers and use Mandate Autopay to schedule recurring payments so dues are cleared automatically.

Payments use standard UPI authentication and follow secure digital payments practices. Transactions show instant confirmations for instant money transfer; settlement timing to billers or merchants follows partner settlement windows and is visible in the transaction summary. For individuals, you can instantly send money to bank account from UPI — one of the fastest, safest ways to transfer in India.