Invest In Mutual Funds With Confidence

Start SIPs from ₹100, set clear goals, and track progress with one simple app.

Invest Now Explore MFs

Start SIPs from ₹100, set clear goals, and track progress with one simple app.

Invest Now Explore MFs

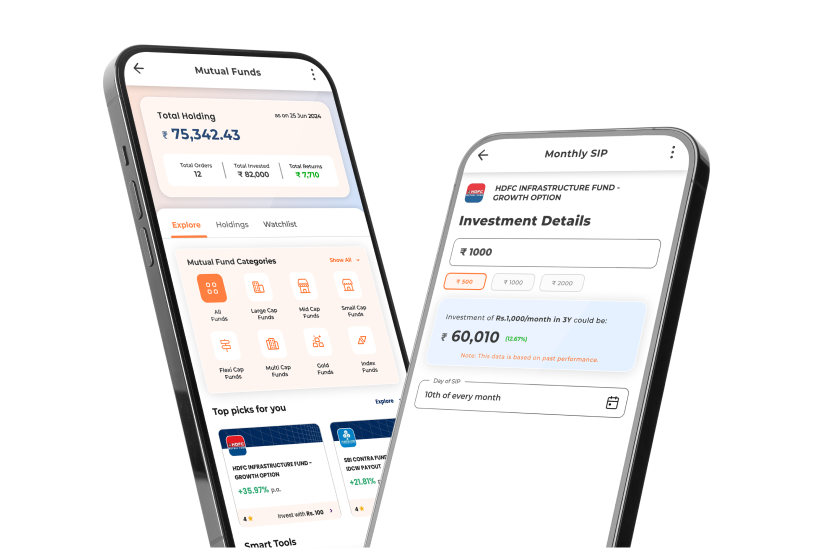

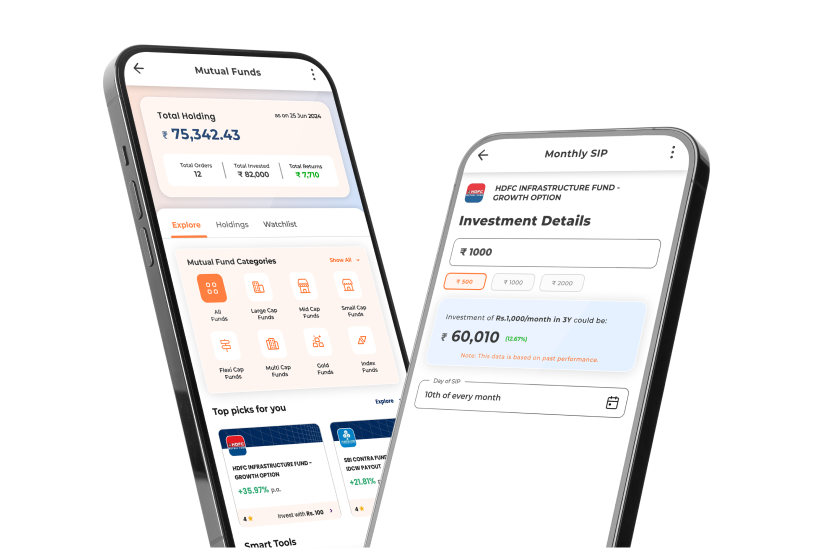

Focused on mutual funds, designed for you.

SIP & lump sum projections with compounding.

Build monthly contribution plans for milestones.

Track XIRR, absolute returns, and fund metrics.

Begin with your time horizon and risk appetite. Compare equity funds, debt funds, hybrid funds, and index funds on historical performance, expense ratios, and volatility. Our goal-based investing flow and fund insights show live NAV, past returns, and differences in fund categories, expense ratios, and historical performance.

A SIP is a disciplined way to invest fixed amounts at regular intervals. SIPs help with rupee cost averaging and compound growth. For long-term wealth building, SIPs in diversified mutual funds such as equity or hybrid funds often improve consistency in mutual fund returns compared to infrequent lumpsum timing.

Yes. Investing in regular mutual fund schemes on Indipe ensures distributor support and transparent processes. Charges are clearly displayed, and you can check live NAV updates and use the mutual fund calculator to project your long-term returns.

SIPs can be paused, modified, or stopped through your account. Lumpsum investments can be redeemed subject to scheme exit loads and settlement rules. Use performance reports and live NAV to time redemptions, and consult fund documents for lock-in details on products like ELSS or funds with specific exit conditions

Yes — purchases are held in insured custody with secure vault storage. Holdings are auditable and downloadable for records, making this a trusted approach to online gold investment. Holding gold digitally also serves as a smart way to use gold as an inflation hedge, ensuring your wealth grows while protecting against rising prices.